All reviews

A crypto exchange guide must provide reviews of all of the crypto exchanges out there, so that you can find the right one for you. This review of Binance consists of four parts: general info, fees, deposit methods and security.

General Info

Binance is an exchange previously based in Hong Kong and is one of the absolute giants in the industry. It launched in July 2017 and has then really developed into the market leader among cryptocurrency exchanges. The business department at Binance did however ask us to specify that the company was based in Malta, and not Hong Kong. Malta is together with Estonia and Gibraltar one of the few countries in Europe that has developed explicit license requirements for cryptocurrency exchanges.

Binance regularly places itself on no. 1 or at least top 3 in terms of 24 hour trading volume, meaning that it is regularly the most (or at least one of the most) trusted exchanges in the world. On 14 April 2020, right in the middle of the crisis with COVID-19, Binance had a reported 24 hour trading volume of USD 4.0 billion (the highest in the world) and a 30 day trading volume of USD 139.7 billion (also the highest in the world). Binance is the dragon among dragons when it comes to crypto exchanges.

Futures Trading

On 17 September 2019, Binance officially launched their futures trading. Futures are also known as option contracts. An option contract is a contract that gives the holder of the option a right – but not an obligation (thus an “option”) – to buy (call option) or sell (put option) a certain asset at a certain price. Certain options give you the right to exercise the option whenever (before expiry of the contract), and other options are only permitted to exercise during a specific date. The former are known as American Options, and the latter are known as European Options.

You can trade both Perpetual Futures and Quarterly Futures here. The following shows the fees charged for each such contract category, with specifications of how it changes due to your VIP-level (0-9):

The fees charged by Binance for its futures trading are a bit below industry average, as the standard taker fee is 0.075% and the standard maker fee is 0.025% according to our research.

Sign up on this link to save 10% of your trading fees on your futures trading forever.

Trading Alternatives – Basic & Advanced

Binance-users have the opportunity to choose between two different trading alternatives. The first one is called basic, and does not cater as good to people interested in more detailed technical analysis as the advanced version does. None of them can really be considered extremely easy-to-use though. The basic version’s trading view looks like this:

As is evident from the picture, the basic trading view is quite straight-forward and inherently easy to understand. Most of the crucial information is included in one page. Prices are to the left, graphs in the middle (with buy and sell options), and the history to the right.

The advanced version’s trading view looks like this:

In the advanced version, the charts take up more space. As in the basic version, the trade history is on the far right. The buy and sell boxes however, are here in the low right corner (instead of in the bottom center as in the basic version). It is of course up to each individual to decide which trading view suits him/her best.

Binance Supported Cryptocurrencies

Binance supports a very large number of cryptocurrencies, several hundred of them. This makes it one of the exchanges in our Cryptocurrency Exchange List with the most supported cryptocurrencies overall. Apparently, the platform also has some form of quality assurance system. This system ensures that projects that have once qualified to be listed but later fails to meet such qualification requirements are delisted. For instance, on 15 February 2019, Binance decided to delist the following five cryptocurrencies: CloakCoin, Modum, SALT, Wings and Substratum.

Binance OTC Trading Portal

In an email to its users on 14 April 2020, Binance announced the release of its OTC-desk. With an OTC Trading Portal (OTC is acronym for Over The Counter), you can execute larger trades without any risk of “slippage”, which is what we call price movements due to large transactions.

In this OTC Trading Portal, there are no trading fees and quick settlement. The minimum trade size for the OTC Trading Portal is an equivalent value of 10,000 USDT, and 25 different coins and tokens will initially be available for trading. Users simply need to have a KYC verified (level 2) account on Binance.com to begin trading.

Binance Lending Product

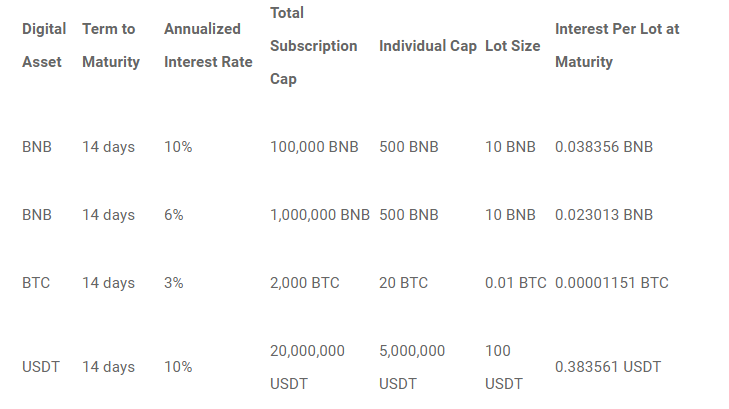

Binance also has so called “Binance Lending Products”. With the use of these, you can lock certain assets in for a certain period and then receive an interest on the locked in assets. On 19 September 2019, Binance released 14-day fixed term lending products, where you receive interest by locking in the assets for just 14 days. The following shows a few return figures with respect to locking in the BNB, BTC and USDT-tokens for 14 days:

Team

This exchange has a very strong team in all possible aspects. The CEO of Binance is actually one of the forefront figures of the entire cryptocurrency industry (together with Satoshi Nakamoto and Vitalik Buterin).

Binance Fees

The fees at any exchange are very important to consider. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. We call makers “makers” because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own. The maker-taker model encourages market liquidity as the makers providing the liquidity often receives a fee discount compared to the takers.

There are also a number of top crypto exchanges who don’t charge different fees between takers and makers. Usually, we call such exchanges’ trading fees “flat”.

Binance Trading fees (Spot Trading)

Binance offers a flat trading fee of 0.10%. Accordingly, Binance does not care about whether you are a taker or a maker. For investors who prefer to pick-up existing orders from the order book, this might be an attractive trading fee model. Binance’s trading fees are far below the industry average which is arguably around 0.25%.

The trading fees are also reduced based on trading volume and holdings of Binance’s native token, the BNB, as set out in the below table:

Binance Withdrawal fees

Withdrawal fees are usually fixed and vary from crypto-to-crypto. If you withdraw BTC, you pay a small amount of BTC for the withdrawal. If you withdraw ETH, you pay ETH. The last time we did an empirical study of the BTC-withdrawal fees in the crypto exchange market, we found that the average BTC-withdrawal fee was approx. 0.0006 BTC per BTC-withdrawal. Binance charges 0.0005 BTC. Accordingly, their fees are competitive.

Deposit Methods

Previously, Binance only accepted deposits of cryptocurrencies and it did not accept any deposits of fiat currency. New crypto investors could then not trade at Binance. However, the exchange announced on 31 January 2019 that credit card deposits were then possible under certain circumstances.